ETF Sage

Canadian ETF knowledgebase

ETF Sage

Canadian ETF knowledgebase

An Exchange Traded Fund (ETF) is a particular type of investment fund that trades on an exchange. Canadian ETFs trade solely on the TSX (Toronto Stock Exchanage). They can be easily and inexpensively bought or sold during market hours, just like a stock.

The majority of ETFs are passively managed, i.e. they do not employ portfolio managers to make investment decisions on their behalf. Most simply track an index, such as the S&P/TSX 60, S&P500, NASDAQ 100 etc - this helps them to keep their costs low.

Investing using ETFs has many advantages.

The advantages of ETFs include:

Like a stock or mutual fund, ETFs are investments and expose you to certain risks.

ETFs can expose you to some additional risks such as:

For a detailed list of potential risks please read the fund's prospectus.

Canadian mutual fund fees have been rated the worst in a global 24-country 2013 survey by Morningstar:

The annual average expense ratio for ETFs is under 1%.

Vanguard, Horizon and iShares all have TSX 60 index-tracking ETFs with expense ratios under 0.12%.

Too few investors understand the critical importance of keeping annual fund fees and expenses low.

A fund's TER (Total Expense Ratio) is the annual total cost of its fees and expenses as a percentage of the fund's total net assets.

Most equity mutual funds have a TER of just over 2% (2.25% is the average). That may not sound 'bad' but consider:

The above is simplified - when you take compounding ( ) into account, the negative impact fund fees and expenses have is actually much worse. How so? The fees and expenses reduce your portfolio value every year, leaving less to compound/grow.

) into account, the negative impact fund fees and expenses have is actually much worse. How so? The fees and expenses reduce your portfolio value every year, leaving less to compound/grow.

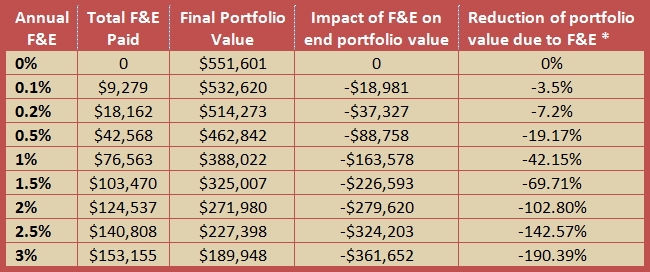

Lets look at the impact of Fees & Expenses (F&E) ranging from 0% to 3% (annually) on a $100k portfolio invested for 35 years (we'll assume 5% annual investment growth):

Yes a 2% annual mutual fund TER ( ) can easily cost $124,537 in fees and expenses over a 35 year period (basis: $100k portfolio, 5% annual investment growth)! How can that $124,537-TER hit make a devastating -$279,620 dent in the final portfolio value? Because that $124,537 in fees and expenses was paid out and could not compound/grow.

) can easily cost $124,537 in fees and expenses over a 35 year period (basis: $100k portfolio, 5% annual investment growth)! How can that $124,537-TER hit make a devastating -$279,620 dent in the final portfolio value? Because that $124,537 in fees and expenses was paid out and could not compound/grow.

With no annual fees or expenses the portfolio would grow to $551,601 but with a 2% annual TER it would only grow to $271,980 - that's a devastating -$279,620 difference.

If you had used an ETF with an annual 0.5% TER, your final portfolio value would have been considerably better: $462,842.

ETFs can be easily and inexpensively bought and sold at any time during stock market hours - you just need to open a brokerage account.

Typically when you buy or sell an ETF you pay a small brokerage fee (also known as a brokerage commission). This is the same fee that you would pay if you buy or sell any stock. It can range from around $30 per trade (charged by some major banks) to as little as $5 per trade (charged by some discount brokers).

However you don't have to pay a cent to purchase ETFs. Questrade and various other brokers now offer commission-free purchases of ETFs via the PACC plans (see below) offered by most Canadian ETF providers. You purchase commission-free - when it's time to sell, you pay the standard commission.

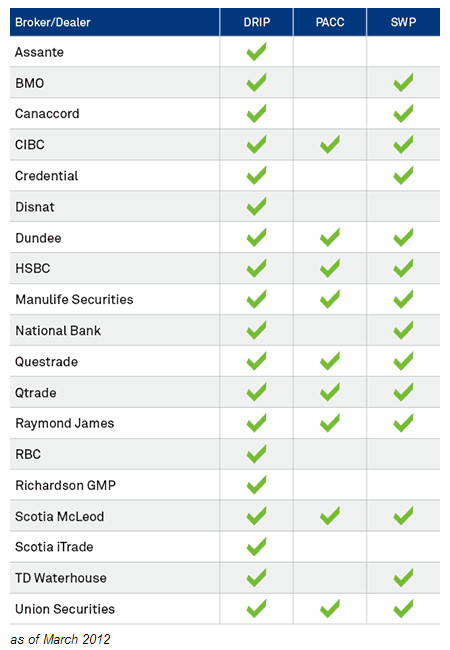

Most ETF providers offer:

E.g. iShares (Canada) plans have the following brokerage compatibility:

The Investment Advisory landscape is undergoing huge changes globally. Some countries, such as Australia and the United Kingdom, are restricting the payment of commissions (or service fees) to Investment Advisors (IAs). The rationale being that such payments can be a conflict of interest and encourage Advisors to recommend products with high-commissions that may not be the best fit for their clients.

Canada will likely be much slower to change. Many Canadian Investment Advisors make the bulk (or a significant portion) of their salary's from mutual fund commissions.

Much research has shown that the majority of actively managed mutual funds underperform their respective index. They also have considerably higher fees. Worse still, Canadian mutual fund fees have been rated the worst in a global 24-country 2013 survey by Morningstar!

IA's should be recommending low-cost index trackers such as ETFs, or the few low-cost index-tracking mutual funds available. By recommending high-fee mutual funds they're putting their clients portfolios under considerably more pressure than if they had recommended low-cost ETFs.

Many analysts believe that annual investment returns of 7% or higher will be much less frequent in the future. E.g. looking at the USA - the total annual return of the S&P 500 during 2000 to 2012 was a disastrous 1.74% ( )! ETF Sage believes the 7% annual investment growth rate figure used by many IAs is too optimistic - we believe a 5% annual growth rate to be more realistic. With lower growth, it is even more important to keep annual fund fees as low as possible. It is foolish to pay 2%+ in annual mutual fund fees in such an environment.

)! ETF Sage believes the 7% annual investment growth rate figure used by many IAs is too optimistic - we believe a 5% annual growth rate to be more realistic. With lower growth, it is even more important to keep annual fund fees as low as possible. It is foolish to pay 2%+ in annual mutual fund fees in such an environment.

IA's need to be paid for their services. They have a far from easy job. Good IAs provide an invaluable service to clients - they should be well paid for that service. But the current compensation model needs to change.

IA-employers should pay advisors a good base salary and phase out mutual fund commissions. Mutual fund fees should be slashed and competitive (like they are in the USA).

Such things probably will not happen for many years.

Thankfully the Canadian ETF marketplace offers an alternative to high-fee poor-performing mutual funds - you'll find 150+ ETFs, the majority index trackers with an expense ratio of less than 1%.

Some articles you should read (links open a new browser window):

Much research has shown that the majority of actively managed mutual funds underperform their respective index. They also have considerably higher fees.

ETFs have significantly lower fees and since most aim to replicate an index's return (net fees) - most outperform the majority of mutual funds with the same benchmark.

These articles should prove very helpful (links open a new browser window):

Canada has seven major ETF providers (links will open new browser window):

A time will come when the majority of Investment Advisors (IAs) recommend ETFs, not mutual funds. The change may take a few years or over a decade - however long it takes, it needs to happen.

Advisors who work on a fee-basis only, not commission, typically recommend ETFs. There are also a handful of Canadian advisors who construct ETF-only portfolios for their clients, not mutual fund portfolios.

Recommending properly selected low-fee index trackers should be Investment Advisor 101. The majority of mutual funds have high fees and underperform their benchmark index - they do a disservice to clients.

We are not investment advisors.

To offer investment advice in Canada you need to be licensed. You also need to fufill the Know Your Client (KYC) requirement which involves meeting the client, understanding their personal and financial situation, their risk tolerance etc.

We are not licensed and have never met you, so it is impossible for us to offer you investment advice.

We try to fresh the data and factsheets every 3 months or so.

We would love a data feed so the data could be kept fully up-to-date, and we don't have to update the data manually (it's a long process which takes a few weeks) but financial data feeds aren't free - they're prohibitively expensive.

ETF Sage has been set-up by a private Canadian individual who wants to help other Canadians. Canadians need to become more investment savvy. We work for decades hoping to retire mortgage-free with a reasonable nest egg.

That possibility is quickly slipping away thanks to poor investment knowledge, negative stock market returns, excessive mutual fund fees and an overinflated property market.

All of us have to do everything we can to change this situation - not just for our future, but our children's too.

Significant change is needed.

The Canadian mutual fund industry needs to change - particularly in relation to excessively high fees and commission payments to Investment Advisors (IAs). Banks and other IA-employers need to pay IAs properly, not make them reliant on mutual fund commissions.

Individual Canadians need to change too. We need to become money and investment savvy. We need to spend a few hours a month reading investment magazines and websites. We need to fully understand our investments, their fees, the potential gains, risks, the other options available.

We should be able to count on Investment Advisors (IAs) but mutual fund commissions, low IA base salaries and tough sales targets has forced the majority to recommend mutual funds when ETFs are cheaper and clearly superior.

Australia and the United Kingdom are restricting the payment of commissions (or service fees) to Investment Advisors as they believe (like I do) that they are a clear conflict of interest.

When will Canada follow suit?

This conflict and the fact that Canadians pay some of the highest mutual fund fees in the world (Morningstar rates Canadian mutual fund fees highest in global 2013 survey) so incensed me that I created ETF Sage.

We applaud the Canadian ETF providers. ETFs are robust low-fee investment vehicles - they are also an excellent way to invest whilst also avoiding the tyranny of Canadian mutual fund fees.