ETF Sage

Canadian ETF knowledgebase

ETF Sage

Canadian ETF knowledgebase

At time of writing (May 2013) this ETF uses currency hedging although this fact is not mentioned on the fund's Home Page (at Invesco), fact sheet or eluded to by its name (which does not contain 'CAD hedged'). This important detail is only revealed in the fund's 50+ page prospectus.

The PowerShares Tactical Bond ETF provides the opportunity to gain exposure to a tactically managed, diversified fixed income portfolio of ETFs with the potential for monthly distributions.

The ETF seeks to achieve income and capital growth by investing in a portfolio of PowerShares ETFs that invest in Government, Corporate and Real Return Bonds.

It will make tactical shifts based on economic conditions and opportunities.

The ETF will use derivative instruments to seek to hedge all or substantially all of its direct U.S. dollar exposure back to the Canadian dollar.

In order to achieve its investment objective, the PowerShares ETF may invest in securities of PowerShares portfolios, securities of Invesco Funds that are not PowerShares portfolios, fixed-income securities, futures contracts and/or securities of exchange-traded funds that are managed by third parties, provided that such holdings are consistent with its investment objective. The PowerShares ETF invests primarily in PowerShares portfolios that are either listed on the TSX or on a recognized U.S. stock exchange.

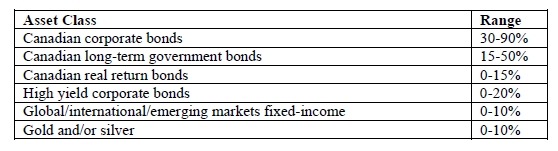

The portfolio of the PowerShares ETF is allocated by Invesco Advisers among the asset classes according to the following ranges:

| Fundamentals | |

|---|---|

| Category (main) | Fixed Income: Government & Corporate (investment and non-investment grade) |

| Category (other) | Fund of Funds |

Underlying Index  |

No single index. Fund of Funds |

| ETF Structure | Mostly passive management. Active management component is tactical shifts at manager's discretion * |

Asset Class  |

Fixed Income |

Region  |

Global (mostly North America) |

| Issuer | Invesco (Canada) |

| ETF Home Page | Available here |

* Since active management component minimum this ETF will be included in Active and non-active categories

| Fund Facts | |

|---|---|

| Inception Date | Aug 24, 2012 |

Total Holdings  |

362 |

Distribution Frequency   |

Monthly |

Leverage  |

None |

Significant Currency Exposure

|

Yes |

Currency Hedging

|

Yes |

| Fees | |

|---|---|

Management Fee  |

0.49% |

Management Expense Ratio (MER)  |

0.50% * |

* Forecast approximate MER (actual may differ)

| Trading Information | |

|---|---|

| Ticker | PTB |

Exchange  |

TSX (Toronto Stock Exchange) |

Currency  |

CAD |

| Eligibility | |

|---|---|

Eligibility *  |

RRSP, RRIF, RESP, TFSA, DPSP, RDSP |

DRIP available **  |

Unknown |

PACC Plan available **  |

Unknown |

SWP available **  |

Unknown |

* Always check eligibility with your plan operator as plans and accounts can differ

** Not all brokers can facilitate these plans. Check with your broker.

To view the TSX or Morningstar fund page for this ETF click on the Fund Data menu tab or below:

Bonds/fixed income funds should be an important component in most investment portfolios. The general rule of thumb is that you should have the percentage equivalent in bonds as per your age. So if you are 30, your portfolio should comprise 30% bonds/fixed income funds.

However the bond markets are in near unprecedented territory. Years of central bank stimulus packages and ultra-low interest rates since 2008's Financial crisis have created a massive bubble.

Many analysts including Peter Boockvar, managing director and chief market analyst at The Lindsey Group, agree. He stated in July 2016 that the bond market is in an ‘epic bubble of colossal proportions’.

Until the buddle bursts, we cannot recommend buying bonds/fixed income funds.

If you absolutely have to buy bonds/fixed income funds then ensure you always check the Yield To Maturity (YTM), also known as the Weighted Average Yield To Maturity.

The YTM is much more important than the bond's current yield (also called the current distribution yield).

The YTM (unlike current yield) considers not only the coupon income, but any capital gain or loss that an investor will realize by holding the bonds to maturity. It also considers reinvestment of the coupons.

Unfortunately the frothy bond market has meant many fixed income ETFs have had to purchase many bonds at a premium. An ultra-low rate environment and purchasing bonds at a premium makes for a particularly terrible climate for income seekers, and new fixed income investors.

Protect yourself by understanding YTM and checking the YTM of any fixed income security you are considering purchasing. Also understand quality ratings, duration and maturities.

Be particularly aware of fund fees. What is the fund's MER ( )? An MER of 0.40% may not sound like much but fixed income funds are supposed to be less risky than equities (bond market bubbles such as the current one excepted) so their returns are typically considerably less. Consequently an MER of 0.40% may actually be a significant portion of any investment return from a bond/fixed income fund. Bond ETFs with sub 0.20% MERs are available.

)? An MER of 0.40% may not sound like much but fixed income funds are supposed to be less risky than equities (bond market bubbles such as the current one excepted) so their returns are typically considerably less. Consequently an MER of 0.40% may actually be a significant portion of any investment return from a bond/fixed income fund. Bond ETFs with sub 0.20% MERs are available.